8 Best Insurance CRM Software in 2026

TL;DR

• We tested 20+ CRMs to find the best for insurance agents, brokers, and agencies.

• The best tools simplify policy tracking, automate reminders, and keep client data organized.

• Some are built just for insurance; others are flexible CRMs that work with the right tweaks.

Selling insurance is less about closing deals and more about building trust, managing renewals, and keeping every little detail—from compliance docs to claim timelines—on track.

Insurance CRMs help you organize contacts, track policies, automate follow-ups, and reduce admin work. And when used right, they make it easier to give clients the kind of service that keeps them coming back.

We reviewed 21 CRM platforms and shortlisted 8 that stood out for insurance use cases.

Some are purpose-built for the industry. Others are highly customizable. All of them passed our usability, features, and workflow tests.

Why You Can Trust CRM.org

We spend hours testing every CRM we write about and comparing it to other CRMs on the market to ensure our readers get the most accurate, up-to-date information. Our core mission is to deliver reliable, independent reviews to help our readers make informed buying decisions and get the most out of their purchases.

The best insurance CRMs in 2026

- Insureio for independent life insurance agents

- AgencyBloc for life, health, and P&C agency management

- Zoho CRM for workflow automation and customization

- Pipedrive for visual pipelines and fast sales tracking

- Radiusbob for Medicare and health insurance brokers

- HubSpot CRM for all-in-one client and lead management

- Freshsales for starting free with built-in communication tools

- Zendesk Sell for high-volume lead follow-up

Insurance CRM vs. Sales CRM: What’s the difference (and which one do you need)?

At first glance, they look similar: both help you track contacts, deals, and follow-ups. But under the hood, an insurance CRM is built for policy management—not just selling, but servicing.

A sales CRM is great for managing leads and closing deals. An insurance CRM goes further: it helps you stay compliant, manage renewals, track carrier info, and store documents securely over the entire policy lifecycle.

Here’s how they stack up:

Insurance CRM

- Tracks policies, not just deals

- Manages renewals, cancellations, and claims

- Handles commissions and carrier appointments

- Often includes secure document storage and license reminders

Sales CRM

- Tracks leads and pipeline stages

- Helps sales reps close deals faster

- Great for forecasting and team performance

- Usually focused on short sales cycles

If you sell policies and service clients long-term, an insurance CRM will save you hours. If you’re just hunting leads and closing quick, a sales CRM might be all you need—for now.

What to look for in insurance CRM software?

How we evaluate and test insurance CRM apps

We tested each CRM as if we were insurance agents ourselves—setting up policy pipelines, importing client data, and running everyday tasks like sending renewal reminders and logging policy details. Here’s what we looked for:

- Ease of use: Can an agent get up and running fast without calling IT?

- Insurance-specific features: Policy tracking, carrier fields, license reminders, commission tracking.

- Automation & integrations: Email sync, lead forms, renewal alerts, carrier data sync.

- Compliance & documentation: Secure storage, audit trails, permission controls.

- Pricing & scalability: Can it grow with a solo agent or scale to an entire agency?

We gave extra credit to platforms with clean UI, strong support, and real-world flexibility.

Best CRM for insurance agents: Comparison chart

Product | Best for | Pricing* | Free plan | URL |

Insureio | Independent agents | $25/month | No | |

AgencyBloc | Agency management | $109/user/month | No | |

Zoho CRM | Workflow automation | $14/user/month | Yes | |

Pipedrive | Visual pipelines | $14/user/month | No | |

Radiusbob | Health insurance | $34/user/month | No | |

HubSpot CRM | All-in-one CRM | $15/month | Yes | |

Freshsales | Starting for free | $9/user/month | Yes | |

Zendesk Sell | High-volume leads | $19/user/month | No |

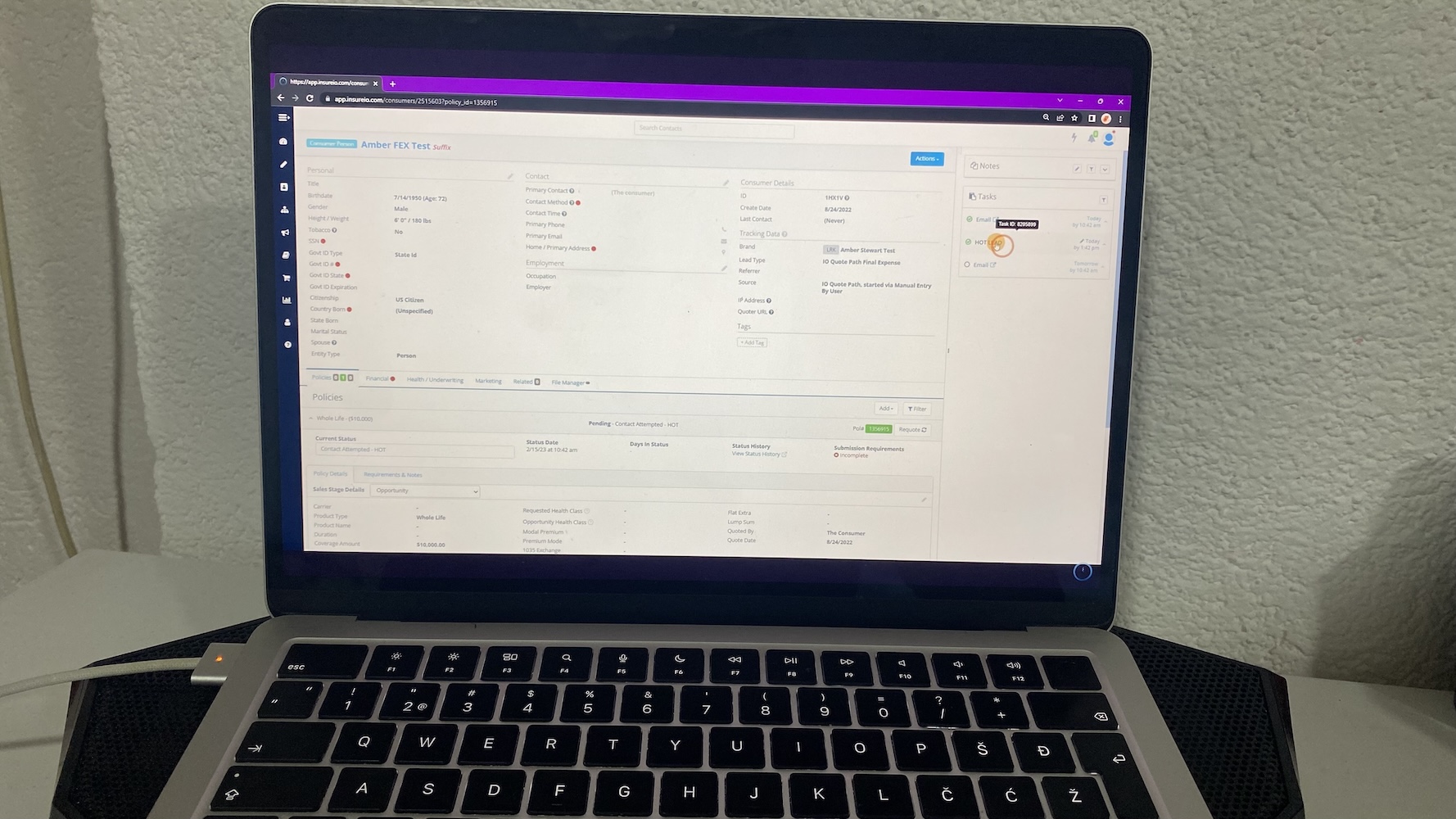

Best insurance CRM for independent agents

Insureio

Pros

- Built specifically for insurance workflows

- Smart policy tracking and quote tools

- Client marketing automation baked in

Cons

- UI feels dated in places

- Reporting can be clunky for large datasets

Insureio is purpose-built for life insurance agents, and it shows. When I signed up, I could instantly customize my dashboard to show leads by carrier, policy status, and client type. No guesswork; just a clear daily to-do list.

The built-in marketing tools are a standout. You can send birthday messages, renewal emails, or onboarding sequences without switching tabs. I appreciated how easy it was to merge carrier data and filter by underwriter too.

It’s less ideal for P&C or health insurance, and the UI isn’t exactly modern. But for life agents juggling quotes, policies, and client comms, Insureio covers the bases.

Pricing

Paid plans start at $25/month.

Helpful next steps

- Try Insureio for free

Visit site

Go to Insureio's official website

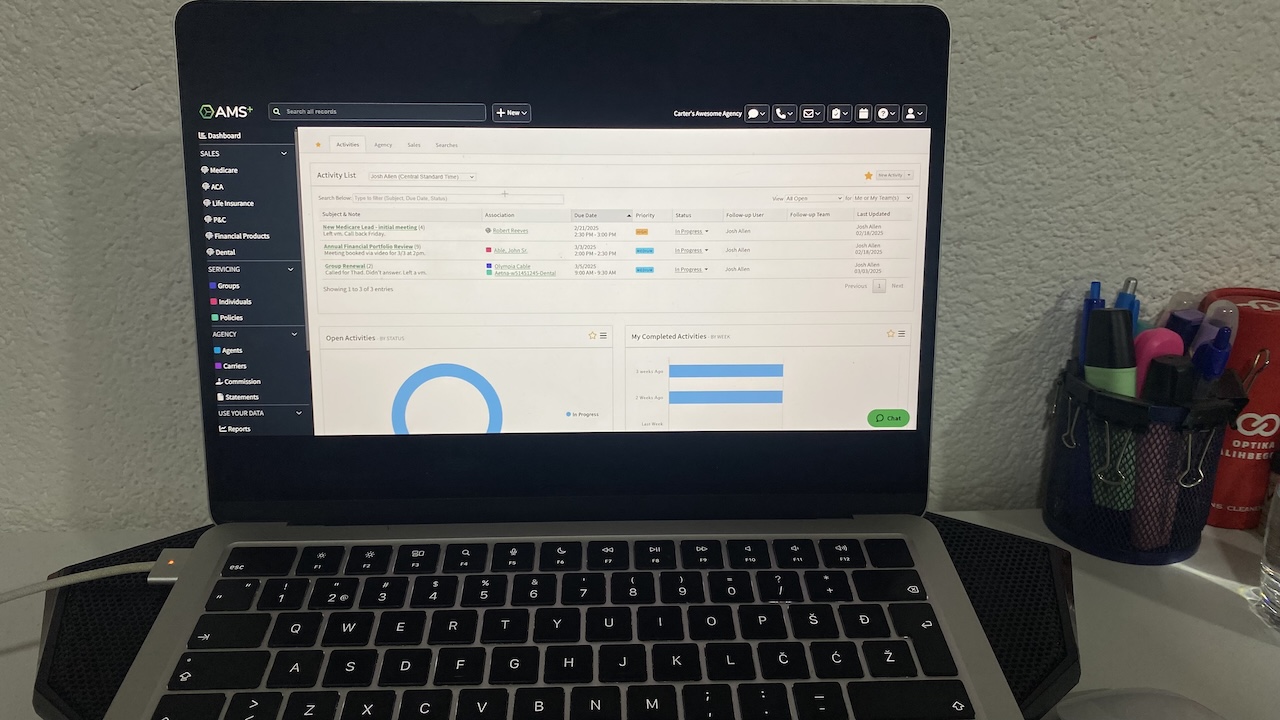

Best insurance CRM for P&C and life insurance agencies

AgencyBloc

Pros

- Full policy lifecycle tracking

- Commission management features

- Strong client + agent organization

Cons

- Not ideal for solo agents

- Limited flexibility outside insurance use cases

AgencyBloc is the closest thing I’ve seen to an all-in-one system for life and health agencies. I liked how easy it was to assign agents to policies, track carrier appointments, and generate commission reports with just a few clicks.

Where it shines is the ability to see a client’s complete relationship history—every email, every policy, every note. It’s a comforting level of transparency when you’re dealing with renewals or service issues.

It’s not as customizable as a general-purpose CRM, and solo agents might find it too much. But if you manage a small team or midsize agency, AgencyBloc keeps everything humming in one place.

Pricing

Starting at $109/user/month; customized pricing available upon request.

Helpful next steps

- Schedule a live demo with AgencyBloc

Visit site

Go to AgencyBloc's website

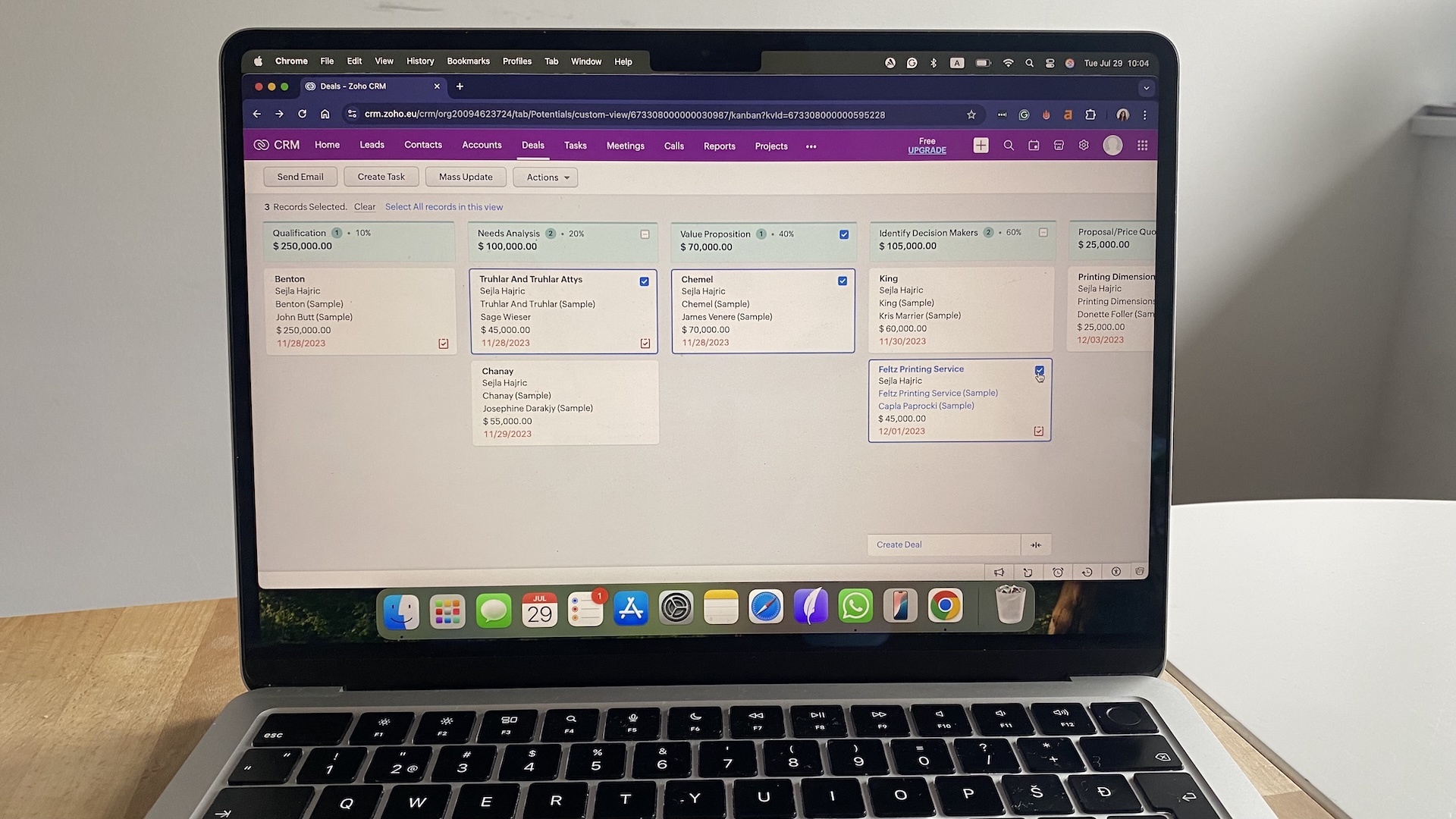

Best insurance CRM for automation and integrations

Zoho CRM

Pros

- Affordable, with flexible tiers

- Powerful automation builder

- Integrates with hundreds of tools

Cons

- Takes time to configure for insurance

- UI can be overwhelming at first

Zoho CRM isn’t industry‑vertical by default, but supports in-depth customization, including insurance use cases. Setup requires investment, especially for insurance workflows, and setting up projects may take several days.

I used its Blueprint feature to map out a full policy workflow: from lead to quote to bind. The drag-and-drop builder helped me automate emails, assign tasks, and set reminders based on custom fields like “Policy Type” or “Carrier.”

I also appreciated how smoothly it integrated with Google Workspace, DocuSign, and even Twilio for texting. It took me about a day to customize everything, but once it clicked, it felt like a powerful co-pilot.

If you need max flexibility and already have a few systems in place, Zoho’s worth the effort.

Pricing

Free for 3 users; paid plans from $14/user/month, billed annually.

Helpful next steps

- Read our Zoho CRM review

- Try Zoho CRM for free

Visit site

Go to Zoho CRM's official website

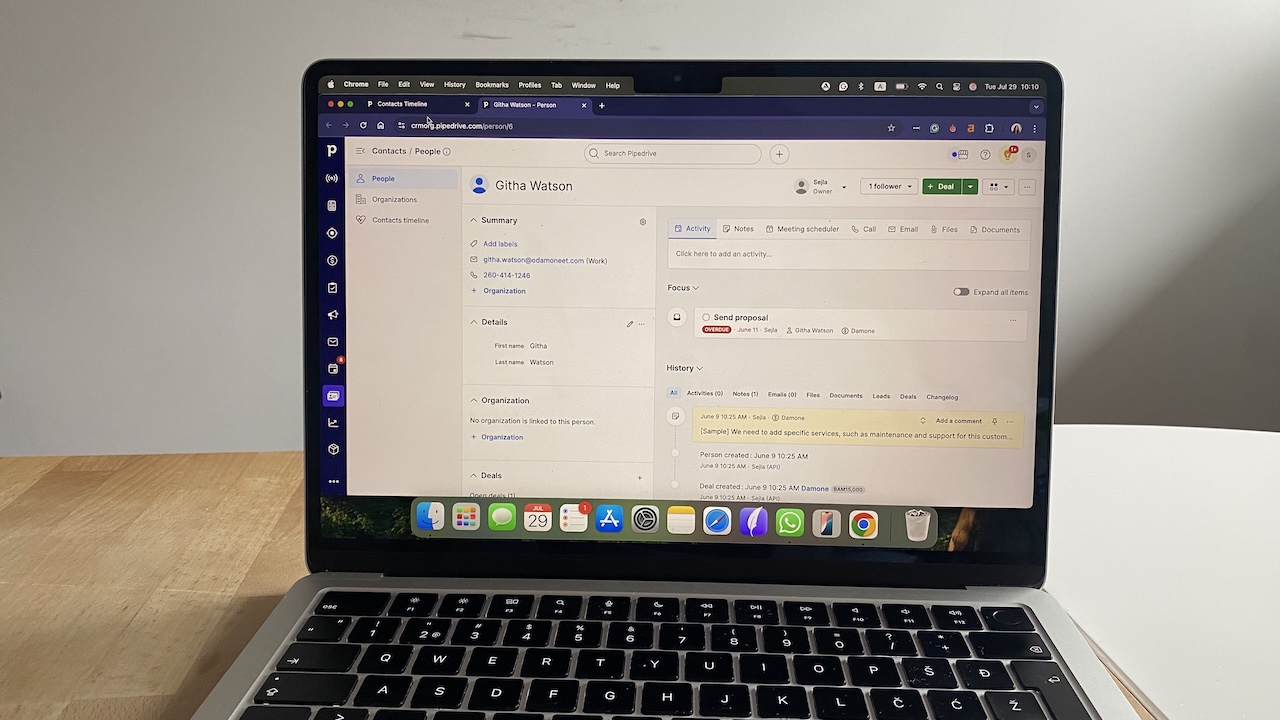

Best insurance CRM for sales-focused insurance teams

Pipedrive

Pros

- Visual, drag-and-drop pipeline

- Insurance-ready with a few tweaks

- Fast setup and intuitive UI

Cons

- Lacks insurance-specific fields out of the box

- Commission tracking requires add-ons

Pipedrive feels like a breath of fresh air if you’ve wrestled with clunky CRMs. I created a custom pipeline for auto and home leads in under 10 minutes. It guided me through follow-ups, quote steps, and renewals like a checklist.

You’ll need to customize fields for policies and carriers, and it won’t handle commission tracking natively. However, there’s plenty of third-party integrations that can help. But if you’re focused on selling and keeping your pipeline clean, it’s hard to beat for speed and simplicity.

Bonus: the automation tools are surprisingly strong once you explore them.

Pricing

Starts at $14/user/month, billed annually.

Helpful next steps

- Read our Pipedrive review

- Try Pipedrive for free

Visit site

Go to Pipedrive’s official website

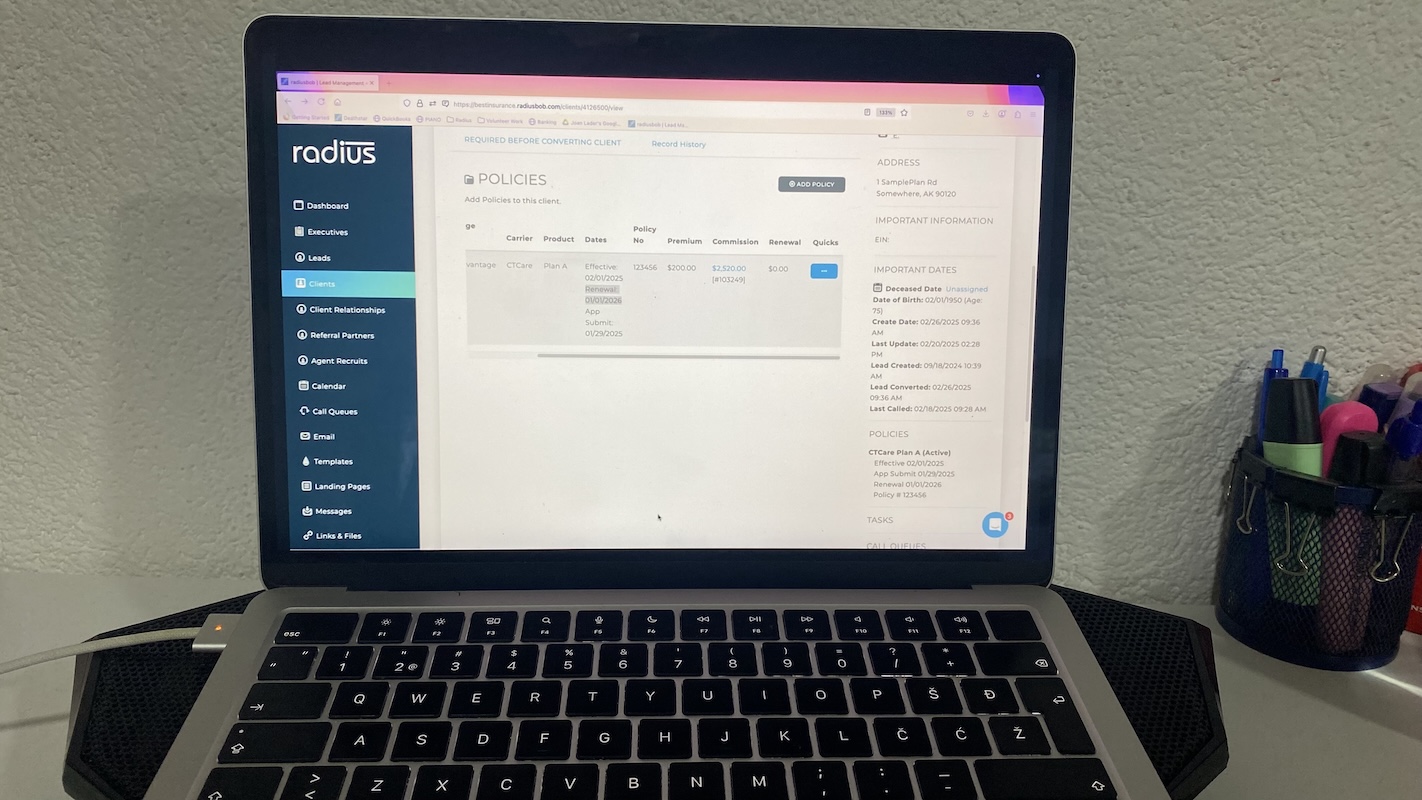

Best insurance CRM for health insurance brokers

Radiusbob

Pros

- Designed for health & Medicare brokers

- Built-in dialer and quoting tools

- Great for solo agents and teams

Cons

- UI feels dated

- Limited customization

Radiusbob is one of the few CRMs that truly “gets” health insurance sales. I tested the Medicare plan comparison tool and could quote policies right inside the platform, no extra tools needed.

It’s not pretty, but it’s practical. You get automated call recording, lead distribution, and reminders for follow-ups, all built-in. The calling functionality in particular saved me tons of time when prospecting during AEP.

If you sell health, Medicare, or group plans, this tool was clearly made with you in mind.

Pricing

Starts at $34/user/month, billed annually.

Helpful next steps

- Try Radiusbob for free

Visit site

Go to Radius' official website

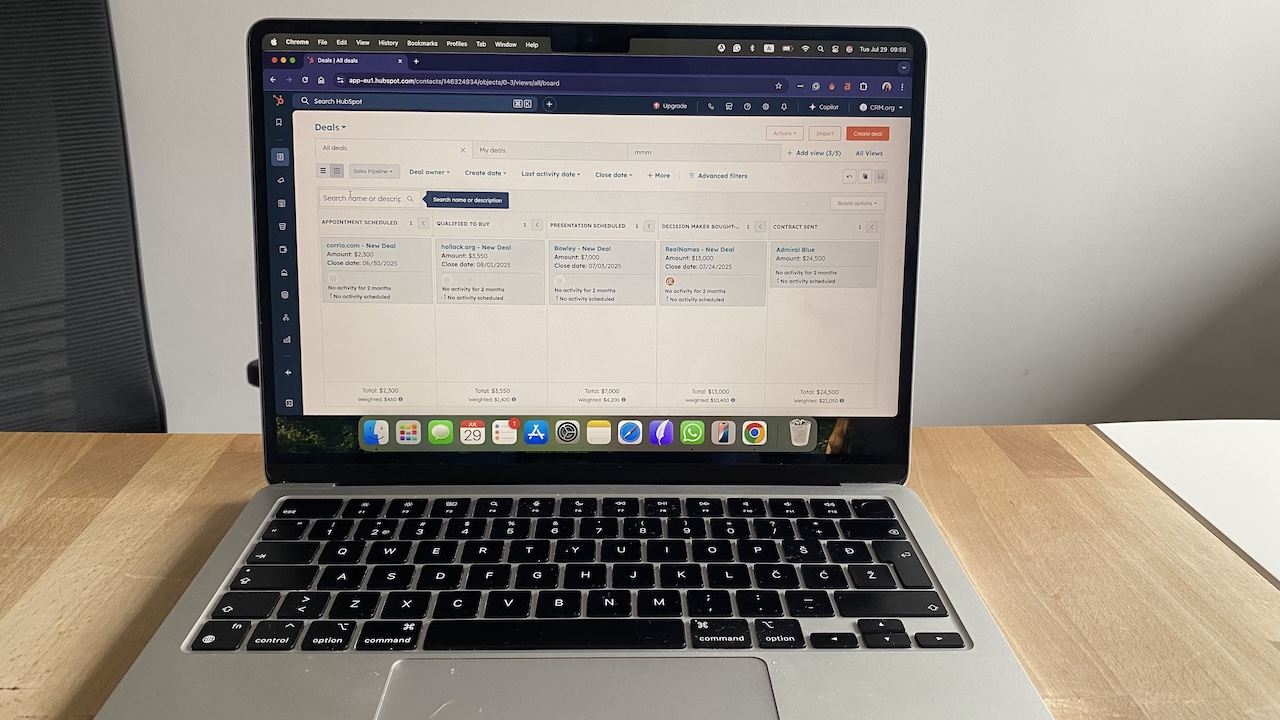

Best insurance CRM for collaborative teams

HubSpot CRM

Pros

- Free plan is surprisingly powerful

- Excellent task and deal management

- Easy team collaboration

Cons

- No insurance-specific templates

- Premium features get pricey

HubSpot CRM isn’t an insurance CRM, but it plays the part well. I appreciated how easy it was to build deal pipelines, assign tasks, and collaborate across sales and service teams. It even nudged me when a follow-up was overdue.

It won’t help you calculate commissions or track licenses, but it excels at keeping clients organized and nurturing leads. With the free plan, it’s a great way to dip your toes in the CRM world before investing in something bigger.

Pricing

Free for core CRM features. Paid tiers start from $15/month, billed annually.

Helpful next steps

- Read our HubSpot CRM review

- Try HubSpot CRM for free

Visit site

Go to HubSpot CRM's official website

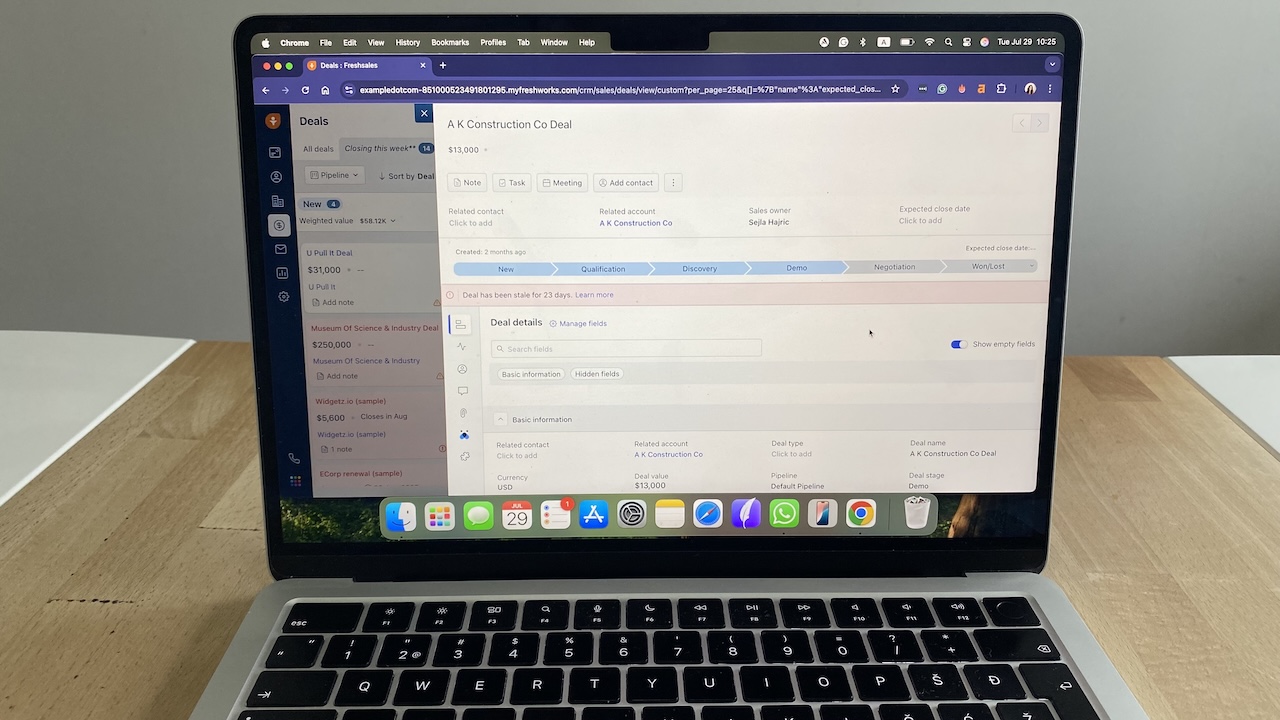

Best free insurance CRM

Freshsales

Pros

- Free plan includes built-in phone and email

- Modern UI with sales-focused tools

- Easy contact and deal tracking

Cons

- Limited insurance templates

- May require workarounds for policies

Freshsales hits a sweet spot for agents who want something clean, modern, and free to start. I liked how quickly I could add leads, create deal stages, and send emails—without touching another tool.

The smart fields and AI suggestions helped surface “at-risk” leads, and the mobile app made quick updates easy during field visits. It’s not insurance-specific, but the basics are all there.

If you’re starting out or looking for a simple CRM to manage leads, Freshsales does more than you’d expect from a freebie.

Pricing

Free plan available. Paid tiers start from $9/user/month, billed annually.

Helpful next steps

- Read our Freshsales review

- Try Freshsales for free

Visit site

Go to Freshsales' official website

Best insurance CRM for high-volume lead follow-up

Zendesk Sell

Pros

- Clean, intuitive UI that’s easy to learn

- Built-in email, calling, and task tracking

- Great for fast-paced, sales-driven teams

Cons

- No native support for policies, carriers, or commissions

- Limited compliance and documentation tools

Zendesk Sell is built for speed. If your insurance business is focused on inbound leads, outbound calls, and fast deal cycles, this CRM helps you move quickly.

It doesn’t come with insurance-specific fields or compliance tools, so it’s not ideal for agencies juggling complex policies or multi-year servicing. But if your team spends the day chasing quotes and closing fast, Zendesk Sell keeps everything moving.

Pricing

Paid plans start at $19/user/month, billed annually.

Helpful next steps

- Read our Zendesk Sell review

- Try Zendesk Sell for free

Visit site

Go to Zendesk Sell's official website

Final thoughts: You’ve got options and support

There’s no universal “best” insurance CRM. There’s only the one that makes your life easier, whether that’s by reminding you about a policy renewal, helping you follow up faster, or giving you a clearer view of your clients.

Start with where you’re at.

Selling life insurance solo? Insureio is made for that. Running a small agency? AgencyBloc keeps policies, agents, and commissions in sync. Just getting started? HubSpot and Freshsales offer solid free plans.

Whether you’re running a solo book or managing a whole team, one of these tools will help lighten the load. And don’t be too lazy to test-drive them all. Tweak the pipelines. Add a few real clients. See how it feels in motion.

You’ll know when it feels right.

Need more help? Check out our related guides:

Insurance CRM Software FAQs

What features should an insurance CRM have?

At a minimum, it should help you track policies, automate follow-ups, store documents, and stay on top of renewals. Bonus points for things like commission tracking, carrier integrations, e-signatures, and secure messaging.

Can I use a regular CRM for insurance?

Yes, but you’ll probably need to customize it. Tools like Zoho, HubSpot, and Pipedrive can work well once you add fields for policies, carriers, and license dates. If you want something ready out of the box, go with an insurance-specific CRM like Insureio or AgencyBloc.

Is there a free CRM for insurance?

There are solid free options (like HubSpot or Freshsales), but most insurance-specific CRMs charge monthly. If budget is tight, start with a general CRM that supports custom fields—you can always upgrade later.

Do I need a CRM if I’m a solo agent?

Absolutely. A good CRM keeps you organized, reminds you about renewals, and stores everything in one place. It’s like having a digital assistant that never forgets a client’s birthday or policy expiration. You can always research personal CRMs if the standard options seem too much for you.

Will a CRM help with renewals?

Yes, and it should. The best insurance CRMs automate renewal reminders, surface upcoming expirations, and help you re-engage clients before coverage lapses.