7 Best CRM for Financial Advisors in 2026

TL;DR

• Financial advisors need CRMs built for trust, not just task tracking.

• We tested 20+ tools. Only 7 made the cut.

• Each pick excels at a specific need: compliance, integrations, segmentation, or workflow automation.

Managing client relationships in finance isn’t just about sending birthday emails and logging meetings. From onboarding new clients to tracking portfolios and prepping for quarterly reviews, a good CRM saves time and builds trust.

We tested over 20 CRM platforms to find the ones that actually support the workflows of financial advisors. These seven stood out for their ability to handle compliance, organize portfolios, and simplify day-to-day tasks.

If you want fewer spreadsheets, faster prep for client reviews, and a system that won’t let anything slip through the cracks, this guide is for you.

The best CRMs for financial advisors

- Wealthbox for ease of use & simplicity

- Redtail CRM for compliance features & automation

- Zoho CRM for custom finance workflows

- HubSpot for SMBs needing CRM, marketing, and automation

- Salesforce Financial Services Cloud for enterprise firms needing custom solutions

- Ugru for built-in financial planning tools

- ClientLook for managing properties & client data

Can I use any CRM as a financial advisor?

You can, but whether you should depends on how you work.

Here’s how they stack up:

General CRMs (like Pipedrive or Freshsales):

- Great for lead tracking and follow-ups

- Easy to use and affordable

- Require customization for financial workflows

Financial advisor CRMs (like Wealthbox or Redtail):

- Built for portfolio-based client relationships

- Help you stay compliant (FINRA, SEC)

- Include features like risk profiling, AUM tracking, and integrations with custodians

Bottom line: if you just need to stay in touch, go general. If you need to prove compliance or manage portfolios, go industry-specific.

What to look for in a CRM for financial advisors?

How we evaluate and test financial advisor CRMs

We signed up, imported dummy data, and built day-to-day advisory workflows to see which tools held up under real pressure. Our top picks were tested against:

- Ease of use: Can you get up and running without an admin team?

- Client management & segmentation: Can you track clients by AUM, risk level, or life stage?

- Integration with financial tools: Does it play well with custodians, planning tools, and portfolio trackers?

- Compliance & security: Does it help meet SEC, FINRA, or GDPR standards?

- Automated workflows: Does it lighten your admin load with smart triggers?

Financial services CRM comparison chart

Product | Best for | Pricing starts at | Free version | Website |

Wealthbox CRM | Ease of use | $59/user/month | No | |

Redtail | Compliance features | $39/user/month | No | |

Zoho CRM | Custom workflows | $14/user/month | Yes | |

HubSpot CRM | CRM + marketing + automation | $15/month | Yes | |

Salesforce Financial Services | Enterprise firms | $300/user/month | No | |

Ugru CRM | Built-in financial tools | $59/month | No | |

ClientLook | Managing properties & clients | Upon request | No |

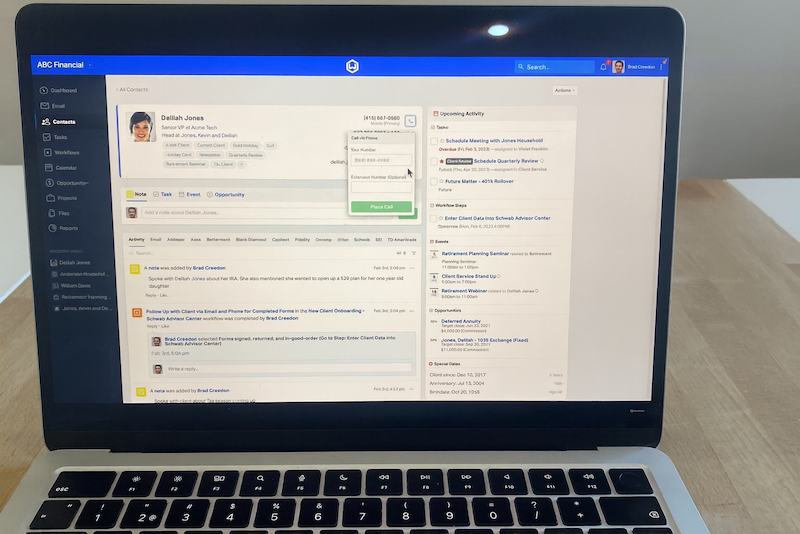

Best CRM for ease of use and simplicity

Wealthbox

Pros

- Clean, modern interface

- Zero learning curve

- Built for financial advisors

Cons

- Customization limited to custom fields and workflows

- No built-in financial planning

Wealthbox is the kind of CRM that doesn’t make you read a manual. I had it up and running in minutes, with everything I needed to track clients, schedule tasks, and log interactions—no fuss. It gently nudges you to follow up or prep for reviews, and the workflow feels more like a to-do list than a maze of features.

If you’re a solo advisor or small firm tired of clunky platforms, this one respects your time. It won’t wow power users looking for complex automations, but for day-to-day client management, it hits the mark.

Pricing

Paid plans start at $59/user/month.

Helpful next steps

- Try Wealthbox for free

Visit site

Go to Wealthbox official website

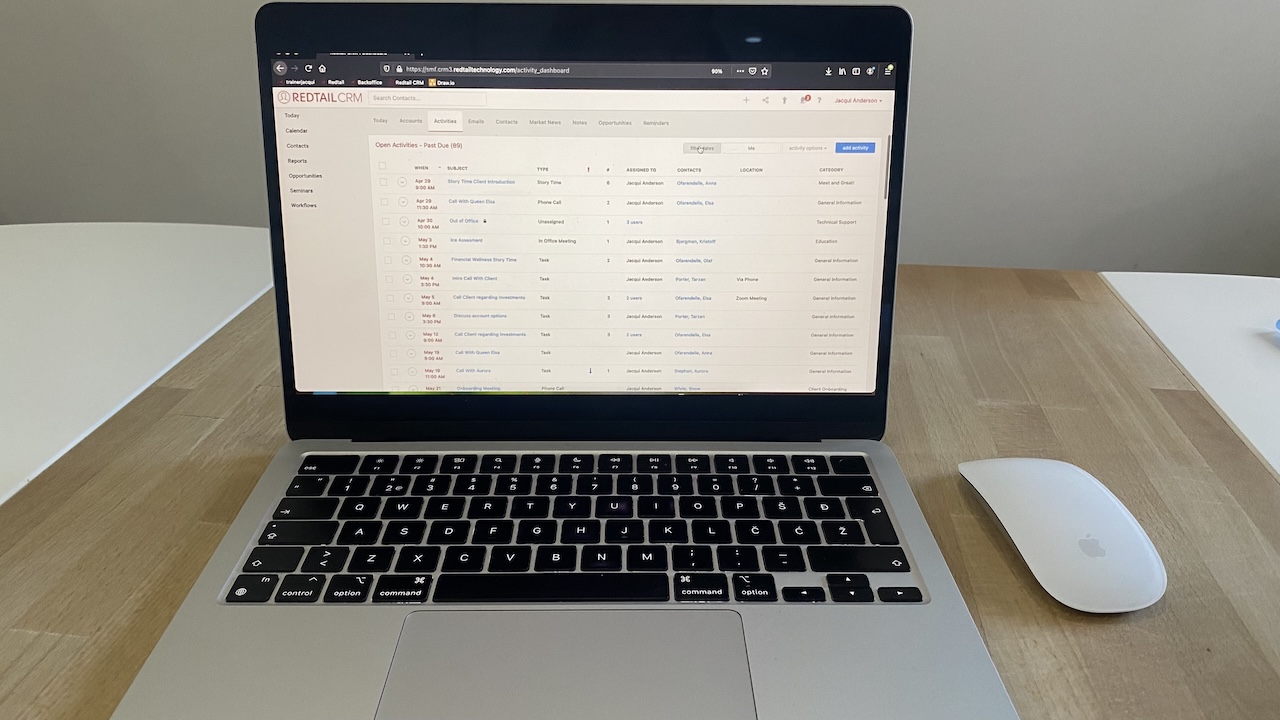

Best CRM for compliance features and automation

Redtail CRM

Pros

- FINRA/SEC-compliant archiving

- Strong integrations plus automation

- Advisor-specific interface

Cons

- Outdated UI

- Some advanced features require add-ons

Redtail has been around the block—and it shows in all the right ways. I appreciated how every email, call, or task is logged and archived automatically. There’s no second-guessing whether you’re meeting compliance standards. It also plays well with tools like Morningstar, Riskalyze, and Orion, so your workflows stay connected.

The interface feels a bit 2015, but under the hood, it’s dependable and smart. If compliance is non-negotiable, Redtail does the heavy lifting.

Pricing

Starts at $39/user/month, billed annually.

Helpful next steps

- Read our Redtail review

- Try Redtail CRM for free

Visit site

Go to Redtail CRM official website

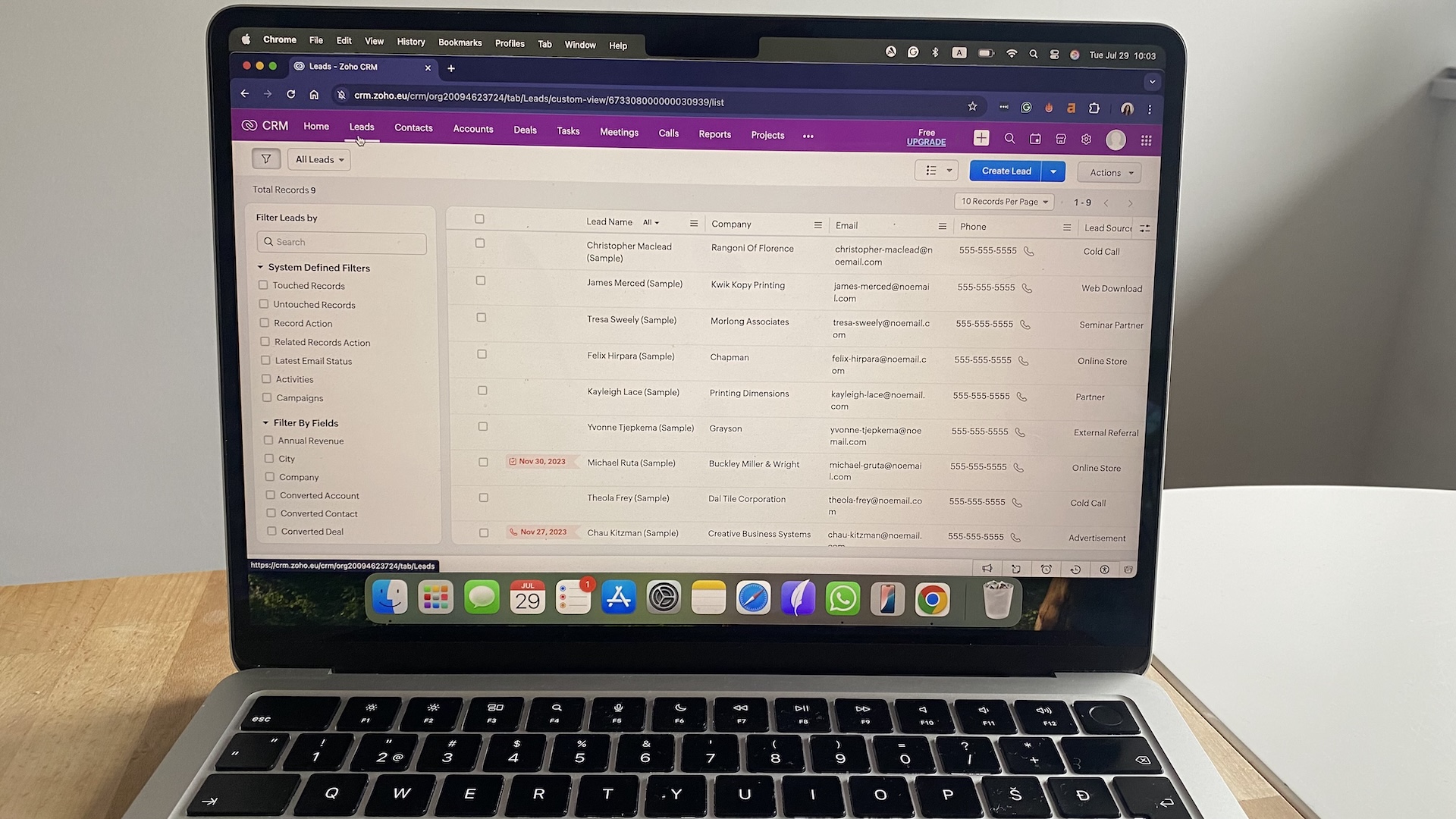

Best CRM for custom finance workflows

Zoho CRM

Pros

- Custom modules for financial tracking

- Affordable and scalable

- Built-in workflow automation

Cons

- Not finance-specific by default

- Initial setup takes time

Zoho is the DIY toolkit of CRMs. I used it to build custom fields for AUM, risk tolerance, and service tiers. With Zoho Flow, I set up automation rules to remind clients about quarterly check-ins and trigger follow-ups after form fills. It’s flexible, especially if you want to create something uniquely tailored to your practice.

Out of the box, it needs some love to work for financial services—but the bones are strong, and the pricing is SMB-friendly.

Pricing

Free for up to 3 users; paid plans start at $14/user/month.

Helpful next steps

- Read our Zoho CRM review

- Try Zoho CRM for free

Visit site

Go to Zoho CRM official website

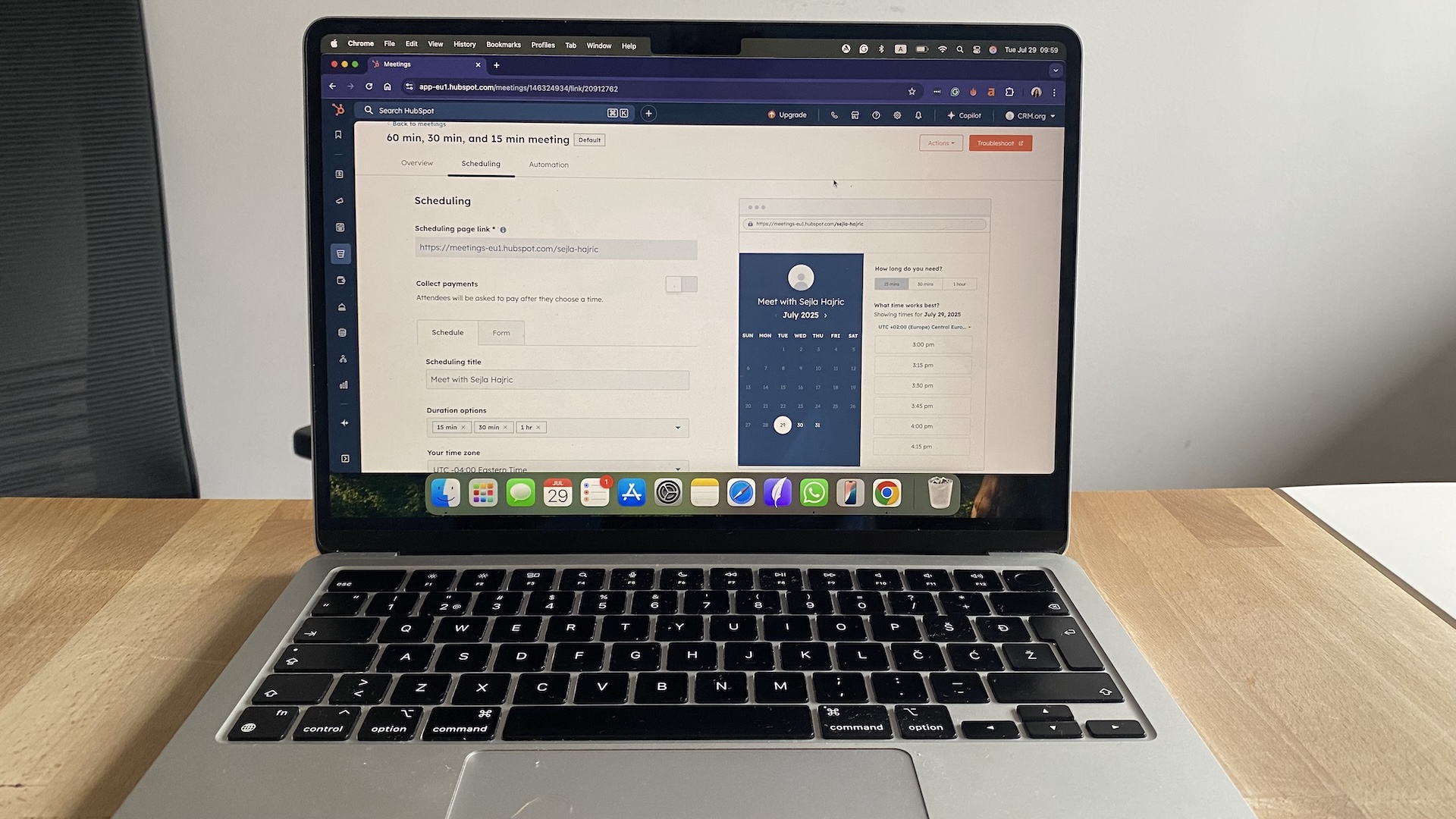

Best CRM for SMBs needing CRM, marketing, and automation

HubSpot CRM

Pros

- CRM + marketing tools in one

- Free plan is generous

- Visual automation builder

Cons

- Premium tiers can get pricey

- No finance-specific features

HubSpot is your all-in-one growth hub. I managed client records, built automated email campaigns, and even added a live chat widget—all without switching tabs. The pipeline views and contact activity timelines made it easy to track who needed what, and when.

It’s not built for financial advisors, so there’s no planning or compliance baked in. But if you’re wearing both the advisor and marketer hat, HubSpot lets you do more with less software.

Pricing

Free core CRM; paid plans start at $15/month, billed annually.

Helpful next steps

Visit site

Go to HubSpot CRM official website

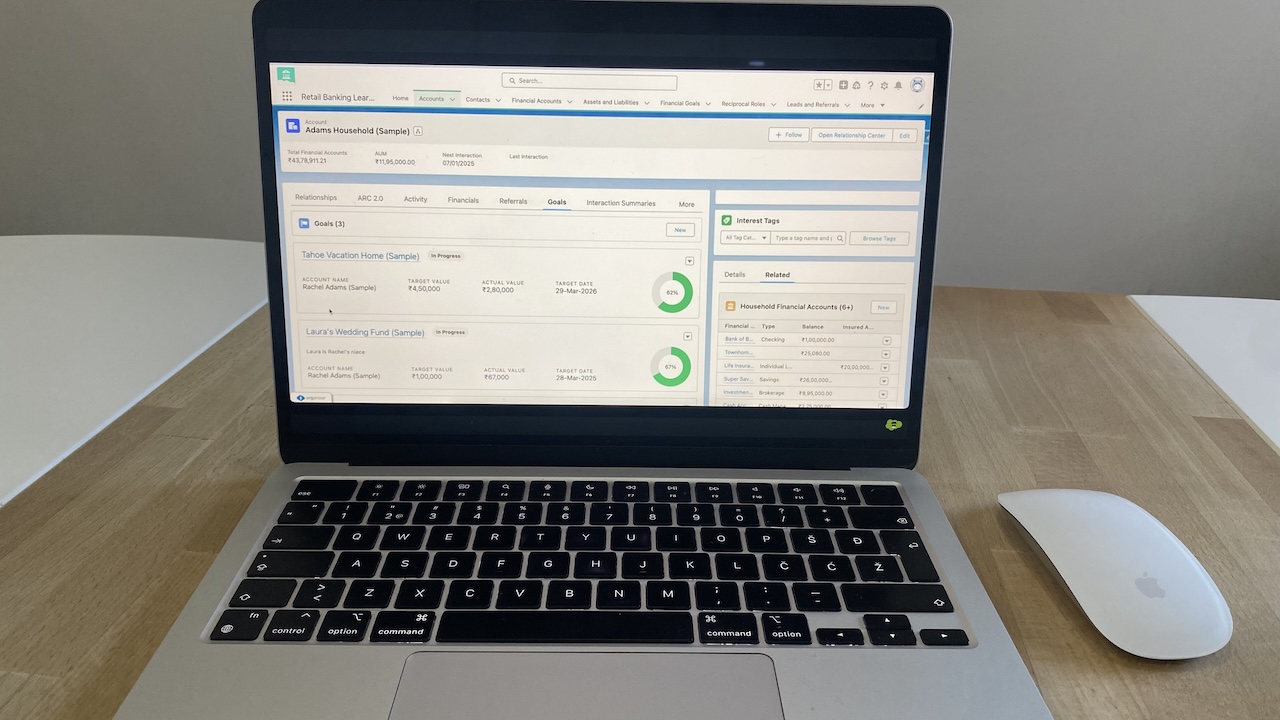

Best CRM for enterprise firms needing custom solutions

Salesforce Financial Services Cloud

Pros

- Deep client segmentation and journey mapping

- Tailored for wealth management firms

- Enterprise-grade automation and security

Cons

- High setup cost

- Requires admin or partner support

Salesforce FSC is a beast—but a well-trained one. I created custom record types for clients, households, and business entities. The platform mapped out entire financial journeys, flagged service gaps, and recommended next-best actions. It’s also loaded with compliance and security tools out of the box.

It’s not plug-and-play. You’ll likely need a consultant or in-house admin. But if your firm runs complex, multi-touch relationships, Salesforce can handle it.

Pricing

Starts around $300/user/month. Enterprise pricing varies.

Helpful next steps

- Read our Salesforce review

- Try Salesforce FSC for free

Visit site

Go to Salesforce official website

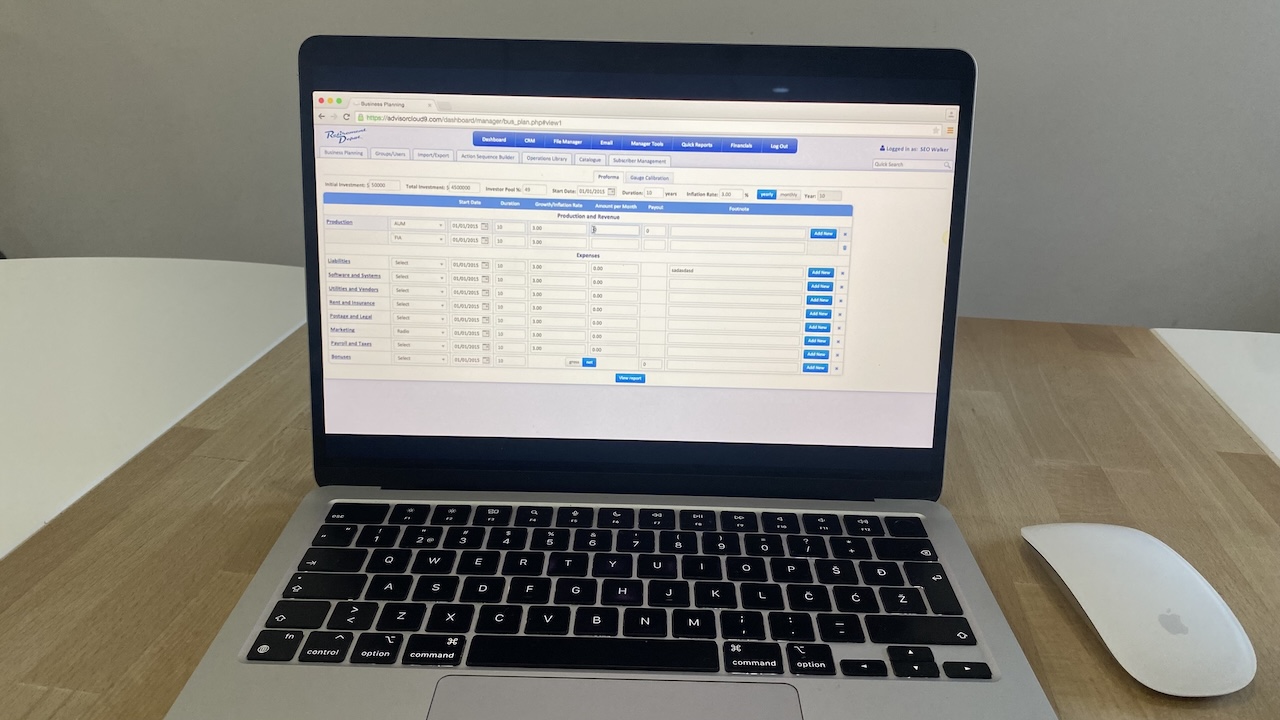

Best CRM for built-in financial planning tools

Ugru

Pros

- Integrated planning, budgeting, and commissions

- White-labeled client portal

- Visual income projection tools

Cons

- Limited third-party integrations

- Interface can feel dated

Ugru packs CRM and planning into one platform. I used it to track client goals, run income simulations, and view my revenue forecasts without exporting a thing. It’s particularly useful for solo advisors or small firms that don’t want to juggle separate planning software.

It’s not the prettiest or most extensible, but it’s practical. If you value utility over bells and whistles, Ugru might be your fit.

Pricing

Paid plans start at $59/month for three users.

Helpful next steps

- Try Ugru for free

Visit site

Go to Ugru CRM official website

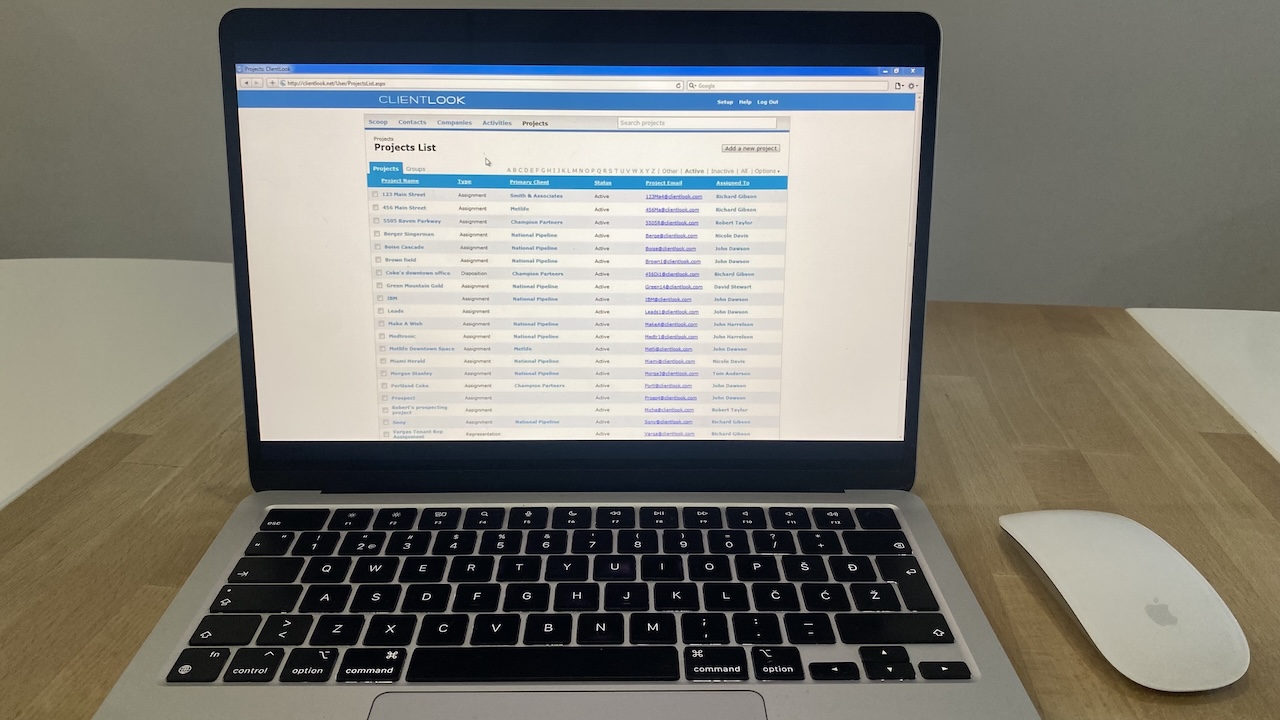

Best CRM for managing properties and client data

ClientLook

Pros

- Combines CRM and property tracking

- Works well for CRE and investment advisors

- Virtual assistant support

Cons

- UI feels a bit dated

- Less customizable than modern CRMs

ClientLook bridges a gap for financial advisors who also manage real estate assets. I linked client records to property listings, lease expirations, and deal stages with ease. The built-in assistant helped me clean up contact data and keep listings fresh.

If you’re juggling financial planning and real estate, it saves you from splitting your workflow across tools. Just don’t expect advanced automation or deep integrations.

Pricing

Custom pricing; contact for details.

Helpful next steps

- Try ClientLook for free

Visit site

Go to ClientLook official website

Final thoughts: Choose the CRM that works how you work

Whether you’re managing a book of HNW clients or building trust with first-time investors, the right CRM is the one that fits your workflow without friction.

Focus on how you work day to day. Are you managing reviews? Handling documentation? Switching hats between planning and service? Let those needs guide your choice, not a bloated feature list.

- Identify your top 2–3 daily needs

- Test a few CRMs using real client tasks

- Pick the one that makes your work easier, without getting in your way

You’ll feel it when it clicks.

Next reads on CRM.org:

FAQs about CRM software for financial advisors

What’s the best CRM for a solo financial advisor?

If you’re just starting out or running solo, look for something simple and intuitive. Wealthbox and Zoho are great picks—they’re easy to set up, affordable, and won’t bury you in features you don’t need.

Do I need a CRM with compliance features?

Yes. If you’re a registered investment advisor (RIA) or fall under SEC/FINRA oversight, your CRM should help log communications, track activity, and store data securely. Tools like Redtail and Junxure build this in.

Can I use a general-purpose CRM like HubSpot or Zoho?

You can—and many financial advisors do. Zoho is especially flexible, letting you customize fields and workflows for financial planning. Just be ready to spend a little time tailoring it to your practice.

What integrations should I look for?

Top CRMs connect with financial planning software (like eMoney, Orion, or Morningstar), calendaring tools, email, and document storage. The more your CRM talks to your tech stack, the less time you’ll spend on copy-paste work.

Is there a free CRM that works well for financial advisors?

Most advisor-specific CRMs are paid, but Zoho offers a decent free tier for up to three users. It’s a great place to start if you want to test the waters without committing.

What if I need to manage complex client segments?

Look for CRMs that support tagging, filtering, and smart lists based on AUM, risk profile, or service tier. Practifi, Salesforce FSC, and Zoho all let you build advanced segmentation rules.