10 Best Accounting Software for Self Employed (FREE & Paid)

Being self-employed comes with its perks. You get to be your own manager, work on your own terms, and make a profit by doing something you love.

But there are downsides: you're on your own when it comes to the accounting aspect of the business. But, with the best accounting software for self employed individuals, this daunting task becomes manageable.

There's a variety of accounting software available specifically designed with the unique needs of freelancers and self-employed individuals in mind.

Whether you're a freelancer or a part-time gig worker, these are the 10 best accounting software for self-employed people like yourself.

Best self employed accounting software comparison (top 10 highest rated)

According to user reviews and our own extensive research, these 10 options surfaced as the best software for self employed. Let's briefly compare each accounting system in terms of pricing and what it's best for:

| Product | Best for | Pricing | Website |

| QuickBooks Online | Best overall | $30 /month | Visit |

| Freshbooks | Ease of use | $15/month | Visit |

| QuickBooks Self-Employed | Beginner freelancers | $15/month | Visit |

| Wave | Free plan | Free | Visit |

| Xero | Freelancers with high income | $12/month | Visit |

| Zoho Books | Mac users | Free plan; $20/month | Visit |

| Sage Accounting Start | Gig workers | $10/month | Visit |

| ZipBooks | Invoicing clients | Free plan; $15/month | Visit |

| TrulySmall Accounting by Kashoo | Accounting amateurs | $20/month | Visit |

| OneUp | Inventory management | $9/month | Visit |

What is the best accounting software for self employed individuals? Here’s our top 10 list:

As self-employed, you want to get paid on time, track your expenses, and see how well your small business is performing. Finding the best accounting software for self employed individuals can be challenging. So we took the liberty of preparing a list of the top 10 solutions.

In the section that follows, we’ll be reviewing each one of those options in detail in order to help you identify the right solution for you. Here are accounting software for freelancers:

1. Quickbooks Online Simple Start (best accounting software for self employed overall)

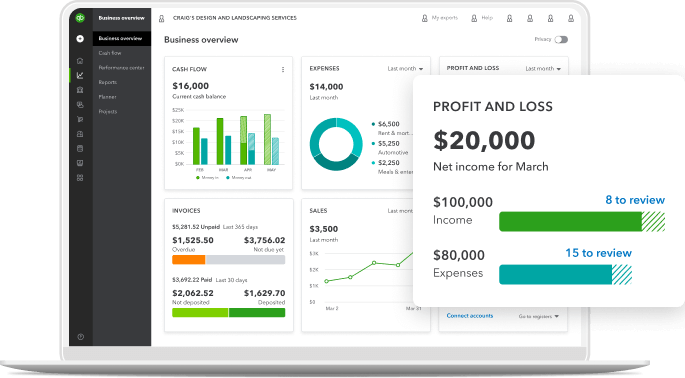

QuickBooks Online is a product developed by Intuit, a company that creates financial products for small and medium-sized businesses. You'll rarely find a person who hasn't heard of QuickBooks, as it has been an industry standard for many years. People have been using QuickBooks Online for many reasons, including its ease of use, a generous set of features, and affordability.

Although there are several monthly plans to choose from, the Simple Start plan is a great option for self-employed individuals. It costs only $30 per month, and you also get a 50% discount for the first three months of using the product. This plan comes packed with all the features self-employed individuals would need to manage their small businesses.

It's a complete accounting and bookkeeping software that lets you do all kinds of things, like create and send invoices, receive online payments, track your income and expenses, create estimates and convert them to invoices, and much more. And the best thing is that the software is adaptable to various business types and industries, whether you’re looking for the best trucking accounting software, the best farm accounting software, or the best legal accounting software.

Another perk of the plan is that you can easily share your books with your accountant or export important documents. You can access a few different reports to check your business's financial status, such as profit and loss reports, expense reports, balance sheets, and more. QuickBooks Online has a mobile app for iOS and Android users.

With the app, you'll be able to enter transactions, record your business expenses, and send invoices. The mileage tracking functionality is a good-to-have feature if you use your car for work. The feature is built within the software to let you track business-related miles by using your smartphone.

And if you ever outgrow the Simple Start plan, you can easily upgrade to the next best plan, like QuickBooks Online Essentials or Plus.

Pros:

- Easy to use

- Suitable for beginners

- 50% discount for the first three months

- Comprehensive mobile app

- Complete small business accounting solution

- Scales with your business

- Integrates with other QuickBooks products

- Accountant access

- Comprehensive reporting tools

Cons:

- The plan is limited to only one user

- Slow customer service

Pricing:

- Simple Start: $30 /month

Visit QuickBooks Online

2. Freshbooks (easiest accounting software for self employed individuals)

This list of best accounting software for self-employed wouldn't be complete without Freshbooks, a platform that was originally built with freelancers in mind—that's why it's incredibly simple to use. A software that was once built as an invoicing and time-tracking tool for self-employed individuals evolved into a popular solution for freelancers, sole proprietors, and micro businesses.

The software has many great and easy-to-use features that self-employed business owners will benefit from. Some features include creating and sending invoices, managing clients and projects, tracking billable time, and accepting online payments.

If you're often working on the go, you'll be glad to hear that a comprehensive iOS and Android app lets you do anything from the web version.

The Reports feature lets you see how well your business is performing. You can keep track of every dollar you're making and spending with the General Ledger feature, while the real-time Profit and Loss report gives you insight into the profitability of your business.

There are four paid plans ranging from $15 per month to $50+. If you go with an annual subscription, you'll get a 10% discount. The Lite plan, which costs only $15 per month, is best suited for self-employed individuals.

It lets you have up to five billable clients, send unlimited invoices and estimates, track unlimited expenses, set up automated recurring invoices, and more. There’s even a client portal where your clients can store their credit card info and keep track of pending payments.

However, if you’re billing more than five clients and need more advanced features like bank reconciliation and accountant access, you’ll need to upgrade to the Plus plan that stands at $30 per month.

Pros:

- Intuitive and user-friendly

- 10% on annual plans

- 30-day free trial

- Built for freelancers

- Comprehensive mobile app

- Integrates with 100+ apps

- Advanced invoicing features

- Great tool to track time and invoice clients

Cons:

- The Lite plan is limited to five clients

Pricing:

- Lite: $15/month

- Plus: $30/month

- Premium: $55/month

- Select: contact vendor for pricing

Visit Freshbooks

3. Quickbooks Self-Employed (best accounting software for freelancers)

Freelancers who are just starting out have a lot to gain from QuickBooks Self-Employed. The software is built to help freelancers keep tabs on income, expenses, and tax obligations, especially those who don't have separate business and personal accounts.

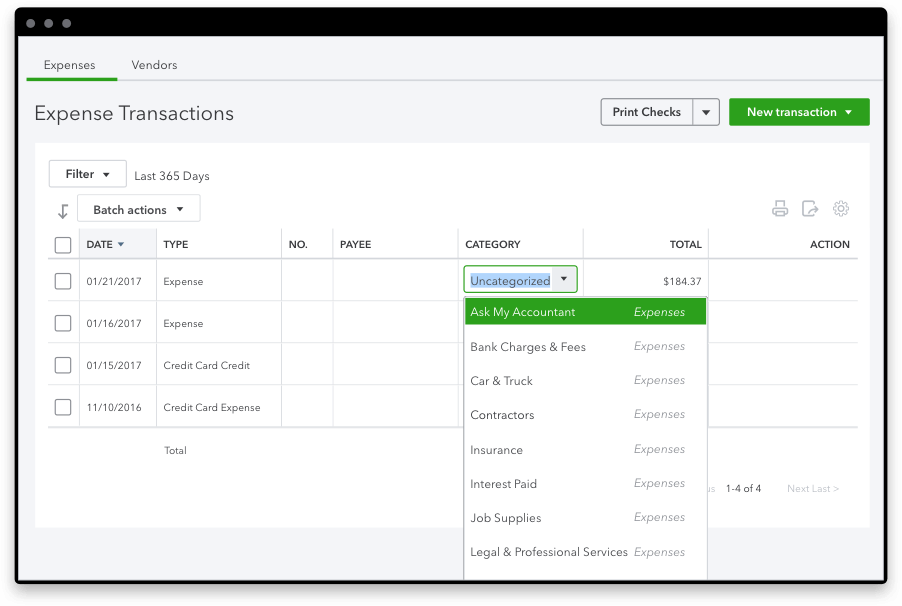

After you connect your accounts, you'll be able to see all of your income and expenses in one central place. You can organize your transactions in two ways: by manually categorizing your income and expenses as business or personal, or by creating rules to automate the process.

In addition to categorizing your transactions, you can also track mileage, create, send and track invoices, and estimate and file taxes.

There are three monthly plans to choose from, ranging from $15 per month to $35. The Self-Employed plan is ideal for freelancers with very basic needs, while the Self-Employed Tax Bundle lets you pay your estimated quarterly taxes online. The Self-Employed Live Tax Bundle

Also includes live support from certified public accountants.

Pros:

- Great for beginner freelancers

- Suitable for managing a side business

- Separate business and personal expenses

- Automatically calculate quarterly estimated taxes

- Pay quarterly taxes online from QuickBooks

- Access to accounting experts

Cons:

- Difficult to scale

- Doesn’t accommodate more than one business

Pricing:

- Self-Employed: $15/month

- Self-Employed Tax Bundle: $25/month

- Self-Employed Live Tax Bundle: $35/month

Visit QuickBooks Self-Employed

4. Wave Accounting (best free accounting software for self employed)

Wave is a free self employment accounting software for individuals who are just starting out with their business and need a budget-friendly solution to streamline their accounting. One major advantage of Wave is that its accounting, banking, and invoicing software is completely free to use.

You can easily and quickly create customized invoices that reflect your unique brand and enable credit card, bank payments, and Apple Pay directly from your invoices. You can even set up recurring billing and payments for retainer clients.

For $0 per month, you'll get unlimited income and expense tracking and the option to add unlimited partners, collaborators, or accountants. Another great thing is that you can connect the software with an unlimited number of bank and credit card accounts.

There is a good deal of reports, including Overdue Invoices & Bills, and Profit & Loss. And if you want to keep business and personal expenses separate to prepare your taxes better, you definitely can.

Although the software is free to use, there are certain fees associated with processing payments. Credit card processing costs 2.9% plus 60 cents for each transaction, and 3.4% plus 60 cents per transaction for American Express. There is a $1 minimum fee and a 1% charge for bank transactions. The payroll add-on starts at $20 per month, plus $6 for each employee or contractor.

Pros:

- Three free programs

- Easy to use

- Unlimited number of users

- Mobile app

- No transaction or billing limits

Cons:

- Full-service payroll is limited to 14 US-states

- Higher fees for credit cards and ACH payments

Pricing:

- Invoicing features, $0

- Accounting features, $0

- Banking features, $0

- Credit card payments, starts at 2.9% + $0.6 per transaction

- Bank payments, 1% per transaction

- Payroll, starts at $20

- Advisors, starts at $149

Visit Wave

5. Xero (top self employed business software for freelancers with high income)

Xero is another tool on our list with strong business accounting features. Xero is one of the best business software for self employed individuals because it's very scalable, meaning it can grow with your business. You can start with the most basic plan and upgrade to a higher tier as your business expands. It supports unlimited users on all its subscription plans, which is fantastic.

Once you connect your bank and credit card accounts with Xero, you'll be able to categorize your expenses, split transactions, and more. Xero also remembers the past transaction categories you used, and it automatically categorizes new transactions for you, helping you save time doing manual work.

In addition to automated categorization, Xero saves you time with other features like recurring invoices, automatic invoice reminders, bulk invoicing, and replication of previous invoices. You can add sales tax to your invoices and estimates, and set up default sales taxes for customers, sales, and purchases.

If you’re a self-employed individual that works with international clients and accepts payments in different currencies, this software would be ideal for you. Xero offers a multi-currency accounting feature that lets you pay and get paid in more than 160 currencies. You can see how currency markets affect your cash flow and profit, and view reports in local or foreign currencies.

The Client Portal is another neat feature that lets your clients view and manage all their transactions. From here, they’ll be able to accept quotes, pay invoices, leave comments, and more.

Pros:

- Unlimited users on all subscription plans

- Scalable

- User-friendly and intuitive

- 800+ integrations with third-party apps

- 30-day trial

- Client Portal

- Multi-currency accounting

- Simple inventory management

- Suitable for freelancers with high income

Cons:

- The more advanced features are reserved for the most expensive plan

- You can’t manage multiple companies under a single account

Pricing:

- Early: $12/month

- Growing: $34/month

- Established: $65/month

Visit Xero

6. Zoho Books (best Mac accounting software for self employed)

There are a few things that give Zoho Books an advantage over other solutions on the market. To start with, it has a free plan that might be enough for freelancers and solopreneurs with basic accounting needs. The free plan includes features such as estimates, invoices, online payments, payment reminders, multi-lingual invoicing, expenses, mileage tracking, bank reconciliation, 1099 contractors, and more.

What’s more, Zoho Books integrates seamlessly with other Zoho products like Zoho CRM and Zoho Recruit, and Zoho Inventory. Another thing that makes this software stand out from the crowd is that it has more payment gateway options than other accounting tools—like Paypal, Stripe, Square, Worldpay, and Forte—which means more variety for your clients.

You’ll have 16 invoice templates that are fully customizable; you can add your company logo, change fonts, add digital signature, and more. You can even charge customers in their currency as the software supports multi-currency invoices. You can even create recurring invoices for your regular customers and retainer invoices if you collect advance payments from your customers.

Pros:

- Multiple monthly plans to choose from

- Free plan

- Integrates with other Zoho products

- More payment gateway options than other accounting tools

- A good deal of automation features, including automated workflows

Cons:

- There’s a learning curve

- You can’t manage multiple companies under a single account

Pricing:

- Free

- Standard: $20/month

- Professional: $50/month

- Premium: $70/month

- Elite: $150/month

- Ultimate: $275/month

Visit Zoho Books

7. Sage Accounting Start (best online accounting software for self employed gig workers)

Sage Accounting Start is an entry-level accounting software designed for gigi workers managing a micro-business.

There are several invoice templates you can customize to fit your brand. You can even add a "pay now" button to your invoices so that customers can pay instantly from their own devices. You can track the status of your invoices, so you always know if a customer has missed a payment.

Using the receipt capture feature, you can take pictures of your receipts and upload them to Sage. All the receipt information will be automatically extracted and categorized. Once you connect your bank or credit card accounts, Sage will automatically categorize incoming transactions as well.

The main dashboard is very easy to understand and gives you a quick insight into things like how your business is performing, who you owe, and who owes you. You’ll have access to dozens of reports to identify trends, get all the data you need to make informed decisions, and ensure your business performs at its best. If you have an accountant, you can easily share these reports with them with the quick export function. Additionally, you can give them complete or restricted access to the software.

This can be an excellent option for a beginner if you're just starting out. The good news is you can quickly move up to the more robust version, Sage Accounting, anytime.

Pros:

- Create and send invoices

- Track what you're owed

- Automatic bank reconciliation

- Access to Sage Marketplace

- Unlimited users

- Unlimited transactions and chart of accounts

- Great for gig workers

Cons:

- Lacks a payroll feature

Pricing:

- $10/month

Visit Sage Accounting

8. ZipBooks (great self employed accounts software for invoicing clients)

ZipBooks is everything self-employed individuals look for in an accounting solution: affordable, intuitive, and packed with useful features. There’s a free plan that comes with all the basic accounting and bookkeeping features, including unlimited invoices and clients, online payments, and reports. The only downside of the freemium version is that you can only add one bank account.

But if you need slightly more features, you can always upgrade to the Smarter plan that costs only $15 per month and offers additional features like recurring invoices, automated payment reminders, time tracking, and the option to connect multiple bank accounts.

What’s more, you can track your transactions, see how profitable your business is, check who owes you and who you owe, and more. You can use the Accountant Access functionality to give your accountant access to the software so they can prepare your taxes when tax time arrives.

Pros:

- A good deal of invoicing features

- Free forever plan

- Suitable for beginners

- Affordable monthly plans

- Expense tracking and financial reporting

- Accountant access

Cons:

- Lacks mobile app for iOS and Android

- Some features are only available in North America

Pricing:

- Free

- Smarter: $15/month

- Sophisticated: $35/month

- Accountant: Contact vendor

Visit ZipBooks

9. Truly Small Accounting by Kashoo (beginner bookkeeping software for self employed accounting amateurs)

Truly Small Accounting by Kashoo is a lightweight self employment bookkeeping software with incredible ease of use. Even if you're a complete accounting amateur, you won't have a hard time using the software. It's designed for self-employed individuals with no prior accounting or bookkeeping experience and who want to manage these processes without professional assistance.

Even if you run into a problem, there's an extensive knowledge base that contains hundreds of help articles; you can also get multi-channel customer support via phone, email, and chat.

In terms of features, Kashoo comes pre-packed with everything you need to manage your small business. Some of the most notable features include sending invoices to clients, tracking income and expenses, receiving online payments, generating reports to track the health of your business, and more.

Pros:

- 14-day free trial

- Affordable monthly plan

- Great for accounting amateurs

- Extensive knowledge base

- Lightweight solution

- Works with 5,000+ banks worldwide

- iOS mobile app

Cons:

- Lacks an Android app, time tracking, and recurring invoices

- Can’t pay bills

Pricing:

$20/month

Visit Kashoo

10. OneUp (good self employed accountancy software for inventory management)

Boasting 700,000+ users, OneUp is another player in the accounting software industry, although less known than its competitors like QuickBooks. Some of the features you’ll find with this software include accounting, invoicing, inventory and CRM, and are fully available on both mobile and desktop.

OneUp offers great inventory management features, making it a suitable option for self-employed individuals who are selling products.

The software is also very intuitive and easy to use, with a simple dashboard that gives you a quick look at important data like profit and loss, cash flow, and income and expense summaries.

There are five plans you can opt for, although the Self plan is the most suitable for self-employed individuals who are operating with a tight budget. The good thing about the monthly plans is that each plan offers the same features, but only supports a different number of users. For instance, the Self plan supports one user, the Pro two, the Plus three, and so on.

Pros:

- 30-day free trial

- All plans include the same features

- Good option if you’re selling products

Cons:

- The Self plan lacks customer support

Pricing:

- Self, $9/month

- Pro, $19/month

- Plus, $29/month

- Team, $69/month

- Unlimited, $169/month

Visit OneUp

Which self employed accounts software is best for me? Our conclusion

As you can see, there’s a wide range of self employment accounting software on the market, and each has its own strengths and weaknesses.

We voted QuickBooks Online as the best software for self employed people overall because of its ease of use, generous set of features, and affordability. Its Simple Start plan comes packed with all the features self-employed individuals would need to manage their small businesses.

However, QuickBooks Online might not be the ideal option for every self-employed individual.

For instance, Freshbooks has a great ease of use—even better than QuickBooks—and was built specifically for freelancers.

Wave's perk is that it's completely free, which means it can be a good solution if you're on a tight budget. If you're an experienced freelancer with a high income, consider going with Xero, as it's a software that can grow with your business.

Don't opt for a software just because it's trending and has thousands of positive reviews by customers. The most important thing to consider is whether the software meets your specific needs and is something you can afford.

Once you identify your specific needs, you can narrow down your options and choose the accounting software that’s ideal for you. Take advantage of free trials/demos to test the software before you commit to a subscription or make a purchase.

If you want to take a detailed tour of the best accounting software for small business owners, take a look at this comprehensive accounting software comparison chart we prepared for you.